Paypal India users now need to add purpose code to receive and withdraw money to India banks. In an email, Paypal has pointed out to an acccount upgrade wherein Purpose Code is mandatory requirement now to keep your Paypal account active to recieve money.

Purpose Code Mandatory

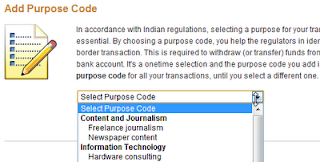

A year back the purpose code was introduced and was only required when you needed to withdraw money to your bank account. Recently, Paypal India made it compulsory for Indian users to add the 3 requirements to withdraw money.

1. PAN or Permanent Account Number

2. Purpose Code

3. Bank account in India.

Many users fail to use the purpose code. But now you need to enter the purpose code also in order to continue recieving funds. This is to comply with RBI guidelines in India in order to receive export-related payments into your Paypal account and withdraw money. The Paypal FAQ clearly state that “Your account will be limited from receiving payments, in case you fail to do so.”

Auto-withdrawal to Bank Accounts

Remember as per recent Paypal restrictions, PayPal users in India are not allowed to hold money in their PayPal account as balance. Instead, all payments received into your PayPal account must be withdrawn to your linked bank account in India. So what if you don’t withdraw the money?

The FAQ reveals that now your funds will be auto withdrawn to your bank account in India, but that requires PAN, Purpose code and Bank Account. Once your data is complete, Paypal can transfer money to your bank account automatically to comply with Indian regulatory requirements.

No comments:

Post a Comment